Clare Sheils, General Manager of CBRE for the Czech Republic, comments: "Given the expected economic recovery, we anticipate that investment activity in the commercial real estate market will continue to rise next year. Investment volumes in commercial real estate should also grow. At the same time, ESG factors will continue to remain a key topic, with companies' main emphasis on energy efficiency, sustainable construction practices and reducing the carbon footprint."

The investment market will follow a positive wave

CBRE experts expect that the revival of investments in commercial real estate in the Czech Republic will continue in 2025. The key factors will be an increase in the supply of suitable real estate for sale, as well as a gradual improvement in financing conditions.

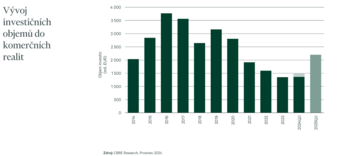

From January to November this year, 1.36 billion euros were traded, which in itself corresponds to the volume of investments for the entire previous year. CBRE therefore anticipates that we will close this year with a total investment volume of around 1.5 billion euros. Additionally, several larger transactions are currently in the final stages of negotiations, so the first quarter of 2025 will be very strong. Starting next year, CBRE expects total investment in commercial real estate to significantly exceed 2 billion euros. Local investors will remain key players. However, the expected return of international capital could strengthen the market even more.

From mid-2022, prime yields, or returns from investments, have increased in the Czech Republic by 60 to 135 basis points across all sectors: from offices to retail real estate to industrial and logistics parks. During the second half of 2024, it was possible to observe their stabilization and in the 4th quarter even their first reduction for shopping parks and real estate on main shopping avenues.

In recent years, investors have begun to place greater emphasis on portfolio diversification to minimize the risks associated with economic fluctuations. As a result, interest is also growing in investments in alternative segments such as rental residences, student campuses or private medical facilities. At the same time, the sustainability of projects is gaining importance. Energy certificates and international certifications such as BREEAM or LEED are becoming key criteria when evaluating investment opportunities.

Jakub Stanislav, head of investment real estate at CBRE, says: "Even if the mood of buyers has improved, it cannot be expected that bank interest rates will continue to fall significantly. The scope for significantly better offer prices is therefore limited. This will make the recovery gradual and it will take some time for investment volumes and capital values to return to their previous peaks.”

The office market is adapting to a new era

During this year, we saw the first signs of recovery in office construction. Currently, more than 160,000 m² of new office space is under construction in Prague, although most of it will not be completed before 2027. This recovery is not driven by pre-leasing, but mainly by buy-to-own projects. Even so, CBRE assumes that it can be a trigger for the start of construction of other projects. Until then, however, the lack of supply of new premises will prevail: only 23,000 m² are planned for completion in 2025 and 2026.

While some large tenants continue to phase-in unused secondary space, the extremely low volume of new office completions will keep vacancy levels below 8% next year. The main reason why corporations reduce the size of their portfolio is not only cost, but also other key factors such as overall impression, quality of environment and flexibility.

Simon Orr, head of the office sector at CBRE, comments: “The current rental market is slow as it adjusts to a higher cost environment. The unanswered question remains whether tenants will be willing to pay much higher rents for newly built offices and increase their costs even more."

CBRE expects around 240,000 m² to be newly leased next year, slightly below the 10-year average of 280,000 m². Relatively few new tenants are still entering the Prague office market, and these newcomers also tend to start in flexible spaces. However, it is the Prague market with flexible and serviced offices that benefits from this trend in the long term and continues to grow.

Helena Hemrová, head of the office leasing department at CBRE, states: "In 2025, we expect that employees will return to offices to a greater extent. Part-time working from home will already remain a fixed part of modern working life, but at the same time the newly introduced working practices that have developed so rapidly in the post-Covid era will begin to stabilize.

The market is witnessing a widening gap between rent levels in premium and secondary spaces. The current highest achievable rent is around 29 euros per square meter per month, and only a slight increase can be expected during the next year. In addition, due to a slow market for new rentals, pressure to increase incentives can be expected in select locations.

The industrial and logistics real estate market is getting used to the new normal

This year, the volume of newly leased industrial and logistics space should reach approximately 800,000 m², which represents a year-on-year decrease of 15%. According to CBRE, rental volumes should remain at the same level or slightly decrease next year. However, the fourth quarter of 2024 saw a slight recovery in new demand, which is a positive sign after a cooler start to the year.

Jan Hřivnacký, head of industrial real estate leasing at CBRE, describes: "Only the beginning of the year will show whether it is only a strong finish to the fading year, or the beginning of a new trend. There is currently no 'XXL' transaction in the market that would significantly increase leasing volume in 2025. Therefore, we currently do not expect a repeat of the leasing levels of 2021 and 2022 anytime soon."

Demand this year was mainly driven by manufacturing companies, which accounted for 60% of the total rental in the first three quarters. The automotive industry was the most active subsector with a share of 69%. It is possible to observe signals of slowly growing activity in the area of e-commerce, however, only next year will show whether it will also be reflected in real leasing transactions.

As of the third quarter of this year, more than 1 million m² of industrial and logistics space was under construction, but new construction is currently slowing down. Developers are anticipating pre-leasing and this trend will continue into 2025. CBRE predicts that around 700,000 m² will be newly delivered to the market this year, which represents a decrease of almost 15% compared to 2023.

The vacancy rate has been steadily increasing over the past months. It was 3.1% in the third quarter, and has continued to increase slightly in the last quarter. In addition, it is still possible to monitor the so-called gray vacancy, which manifests itself not only in spaces offered for sublease, but also in near-completion projects that are formally designated as under construction until they are leased.

Next year, CBRE experts expect that vacancy rates could increase slightly, but not as quickly as in 2024. As a result, we could see continued downward pressure on rents in some of the most competitive regions.

Czech retail is ready for growth

This year, the construction of new retail areas was primarily driven by shopping parks. More than 100,000 m² of such areas are currently in various stages of construction or planning. In terms of shopping center realisation, CBRE expects around 43,000 m² to be delivered to the market next year through renovations or extensions of existing properties. Vacancy rates in existing malls remain low at around 4%.

The improved mood of consumers positively affects the performance of shopping centers. Mall sales rose nearly 5% year-over-year in the first three quarters of this year, well above the rate of inflation. Moreover, they have similar dynamics to the European average. Attendance is stable, with a 1% year-over-year increase.

The real growth of retail spending in the country confirms the recovery of the market after the pandemic and its overall resilience. The positive trend was already visible in the first quarter of this year, when expenses increased by 3.9% year-on-year. That growth continued in the months that followed, eventually beating expectations at 5.3% in the third quarter. For the entire year 2024, year-on-year growth in retail spending is expected to be around 4.3%. In 2025, growth should continue at a steady pace with a projected increase of 4.1%.

Jan Janáček, head of the retail sector and the retail leasing team at CBRE, adds: "After several years of stagnation in the construction of new shopping centers, we see a significant trend in the modernization of existing buildings, whether it is Central Most, Varyáda, Velký Špalíček, Grand Pardubice or Forum Pardubice. With cost growth pressures easing and retailers' appetite for expansion increasing, we expect an increased volume of investment in retail projects in the coming years.”

The highest achievable rents in shopping parks have seen significant growth in 2024. This trend was mainly supported by an increase in tenant demand and persistently low vacancy rates in premium retail locations. Highest attainable rents on the high street increased by 3% year-on-year, with CBRE expecting similar 3% growth to continue in 2025. Shopping centers saw even more robust year-on-year growth in top rents , specifically by 4%. For next year, CBRE expects it to increase by 2%.

This year was marked by more significant activity on the main shopping streets. Máj opened in June, adding 17,000 m² of retail space to the Prague market and attracting new tenants. In autumn, tenants such as Boss, Vasky and Tommy Hilfiger opened their stores in the newly renovated 100Yards building in Na Příkopě street. 28. Octíbrá Street is constantly developing and qualitatively expanding Na Příkopě Street. This year it was strengthened by Lindt and Desigual flagship stores. In the upper part of Wenceslas Square, the long-awaited revitalization also started this year, which will bring the tram line from Vinohrady directly to the center. Construction work will last until the summer of 2027 and can be expected to encourage further interest from retail brands.